In manchen Bereichen beherrschen CFD-Broker digitales Marketing besser als traditionelle Emittenten. Natürlich, CFD-Broker profitieren von einigen unfairen Vorteilen. Dennoch: Traditionelle Emittenten könnten sich in ihrer Marketing-Praxis von ihren Wettbewerbern inspirieren lassen. Das sagt Kees de Koning, Mitbegründer der niederländischen Interactive-Agentur VI Company. (Mit VI Company verbindet uns der gemeinsame Kunde ING Markets). Kees Text halten wir für so lesenswert, dass wir ihn hier (mit Erlaubnis des Autors) präsentieren möchten.

In some areas CFD broker master Digital Marketing better than traditional issuers. Sure, CFD-brokers have an unfair competitive advantage, but taking that in account, traditional issuers can be inspired from them. Says Kees de Koning, Co-Founder and Co-Owner of the Dutch interactive agency VI Company. (We are related to VI Company by our common client ING Markets). We think Kees’ text is worth reading, so we asked him for permission to share it here.

Last month, I had a dinner with a client. My wife joined us as well and at one point she asked: “What is the difference between a CFD broker and a Turbo / Sprinter issuer?” – The client started laughing and answered: “Well, one of them is regulated and hardly knows their actual client. The other is hardly regulated and knows their client really well. A bit too well.”

The answer came out a bit harsh. Why? The client (and other clients) can feel the pressure of the growing CFD business and could feel threatened by it. Let’s be clear: The regulated product manufacture business is a completely different playing field and often held back by regulations. Especially compared with CFD brokers.

But what if you let go of all these constraints and look from a CFD perspective to our regulated market? Call CFD brokers less regulated, bad, or call them anything you like; they do a great job in several areas.

Here are the 7 inspirations:

- Shift from push to pull product offering

Most traditional (Turbo) issuers, issue a whole lot of products with as many different financing levels / knock-out barriers as possible. Yes, in this way, the product issuer is always offering something that is close to the clients’ trading strategy. If the client can actually find it.

By offering such an incredible amount of products; people tend to not find the right product for them at all. You could provide search tools that reverse the product finding from push to pull; No more searching through the offer, but answering the traders’ demand as well as possible. Something the CFD brokers are really good at since they don’t offer products, but “just” answer the demand of the trader. Providing innovative search tools (a knock-out matrix won’t do the trick, sorry) can help shifting the offer-driven product search to a demand driven system. - Market generation-Y

Last year, the CFD broker BUX was introduced in the Netherlands. They do a great job in gamification; you start with “fake”-BUX money, and with a simple button, you can deposit money via direct-debit and trade for real. After that, the transactions performed is shared among friends on the platform. They can even battle against each other. BUX clearly shows they have the guts to market to generation-Y. They do so with extremely informal communications. This way it’s actually fun to be involved. Something the traditional compliance department will never approve. It is perhaps questionable how tactics like these seduce young people ‘gambling’ against the stock market, but it works for them. At least so far. - Social Trading

eToro and Ayondo are beautiful examples of how to well deploy social trading with CFD’s. The concept is beautiful. Follow someone with consistent high returns and do the same. Although, via the CFD brokers, you’re very much dependent on… the CFD broker. A whole different ball game is Wikifolio. Which is also a social trading platform, but instead of using CFD’s, they actually have the possibility to issue an actual regulated warrant / certificate based on the portfolio of the one you’re following. Lange & Swarts provides the Market Making services, Börse Stuttgart the actual issuance on the exchange and the Wikifolio trader defines the asset allocations. Brilliant. - Keep It Simple Stupid (KISS)

The fourth one: Most of the CFD brokers keep their page extremely simple. Somehow, the product issuers have this urge to provide the user with as many tools and information as possible with the belief that their client will be very happy with that certain new tool. In fact, the tools and additional information only diffuses the important information: the product, its behaviour (and legal stuff) and how to buy and sell.

Would you feel comfortable ‘taking a step back’ functionality-wise? Why not provide your clients with a lite edition of the website? See how it works, perhaps a/b-test, and when you’re comfortable enough: Switch. - Show the numbers!

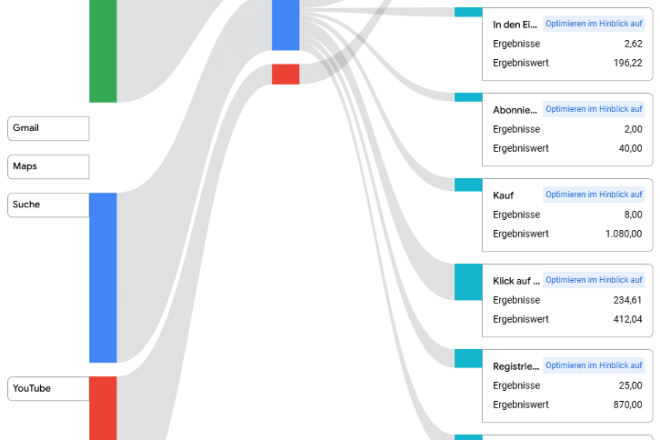

CFD brokers know their clients, their transactions, their holdings, etc. they can do great things with that data. You can’t. Or can you? – As a product issuer, you may not have the exact data of your clients (which is a real bummer), but you can still extract great data from your trading systems. Why not publish aggregate data on the website? What is the turnover in a certain asset class? The amount of trades in the DAX? Many product issuers fear disclosing this data. Well, guess what. You have to do this anyway with MiFID-II upcoming. So why not do it right-away? And for the record: A smart kid can construct (most of) your numbers already anyway. Yes, even from (some) OTC traded derivatives. Publishing the data shows to potential traders: “You’re not the only one thinking of trading this product. Actually, we had X-amount of trades in, just today”. - Be available on all devices

CFD brokers do well on mobile. Some of the product issuers try, but the app is often not what it could be. Rethink your mobile strategy. Should you go mobile first? Have hybrid apps available instead of costly dedicated apps for each mobile platform? Why not provide more functionality on the mobile than on the traditional desktop (like BUX does) or did you think of a direct link between the famous “buy now”-button that could redirect directly to the users’ favourite distributor app? - Provide a demo that is near to real

CFD brokers are annoyingly successful at luring in new clients with their demo accounts. The demo account is often an exact replica of the real environment. You as an issuer can’t do that since your products are all traded via distributors and you can’t mimic all the various distributors’ environments. But you could at least provide them with a real test environment where they can experience what it is like to hit a barrier, to lose or gain money and to pay “real” transaction fees. And gamification wise: You could even show best performing users on your website and let people follow them… see where I like to go to?

I hope these seven take-aways have made you think a bit more out-of-the-box regarding your digital strategy and helps you see with different glasses when you visit a CFD broker website by accident. Providing you with a few new ideas is just the first step in helping you develop the ultimate competitive advantage. How you bring this idea to life is the question, and the next step.

Final take-away

Why not be the distributor of your own products? Just like the CFD brokers? I see many issuers dealing with their favoured distributor, but why not integrate the distribution part into your website? Sure the client can buy the product still at a third party distributor. And yes, other distributors might say “If you do that, we’ll remove you from our shelf!”. They won’t. And if they do: Then you have even more reason to market your own direct distribution channel. Yes, your AUM might fall temporarily, but think of the long term; you’ll be the only one who finally, exactly knows who their clients are. And look how that benefits the CFD brokers.